The future of the insurance business is digital, and most insurance companies are responding to this evident trend to some degree. However, the moves towards digital transformation are often cautious. It is vital to see the potential outcomes of all insurance digital transformation aspects to build a complete strategy.

Find out how modern digitalization capabilities affect the insurance sector and how your business can benefit from adopting the available technologies.

What Digital Transformation Means For The Insurance Industry

In a generic sense, digitalization is moving the user experience online. It is an organic process in any service business sphere that is evolving at a revolutionary pace. However, digitalization in the global insurance industry has many more practical applications besides transforming the customer experience. Here are the main drivers for digital transformation in insurance:

- Providing consumers ultimate access to insurance services from any device and location: it is vital to keep customers happy with their insurance product experience.

- Advanced financial performance reporting capabilities. No more printed reports and vague metrics: automated digital reports, easy-to-understand graphs, and clear key performance indicators to track and analyze the company’s progress.

- More efficient management of business challenges with predictive analytics: the insurance industry is becoming increasingly competitive, and predictive analysis helps meet the market challenges well prepared.

- Automating core business operations: the insurance business highly relies on human labor, which is one of the most expensive resources in the industry. Automation helps reduce operational costs and streamlines multiple processes, resulting in better service quality and a more cost-efficient operational model.

- Modernizing underwriting and claims processing: advanced technologies like artificial intelligence and machine learning help reduce fraud and speed up underwriting and claim-filing processes, improving customer satisfaction.

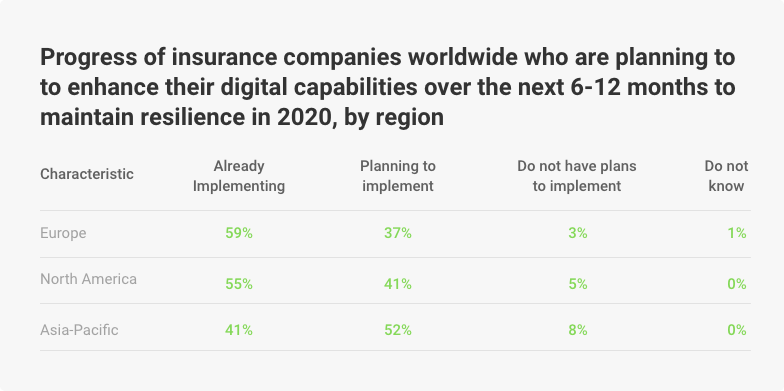

Realizing all these benefits for becoming digital in the insurance sector, the companies globally adopt or plan to adopt new technological capabilities. According to a Statista report for 2020, very few insurance companies have chosen to stay away from digitalization:

The Global Digitalization in the Insurance Sector by Region 2020

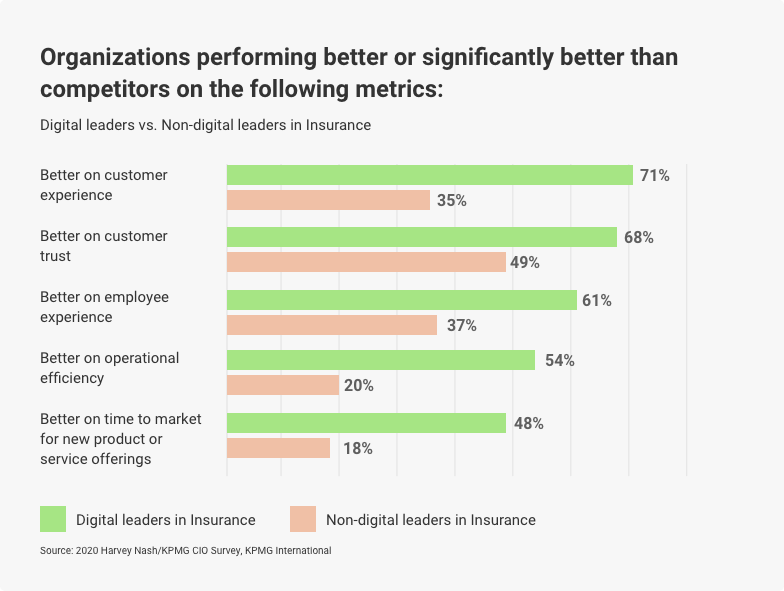

The KPMG’s 2020 CIO Survey shows that the industry’s digital leaders perform better than non-digital leaders by the following metrics:

Performance Metrics of Digital vs. Non-Digital Leaders in Insurance Sector

The digital transformation in the insurance industry is in a hot phase of development and is already noticeable to potential customers. Digitalization helps streamline and simplify existing operations to deliver better performance and become more competitive in the market.

Digital Transformation in Insurance Value Chain

Digitalization brings tangible and intangible benefits in six vital metrics of the insurance business operation:

- Cost reduction

- Speed to market

- Improving customer experience

- Claims efficiency

- Underwriting efficiency

- Boosting sales

Integrating tech innovations into existing ecosystems without imposing new operational risks will bring a sustainable competitive advantage to an insurer. Focusing on the clear priorities for your insurance enterprise, you can choose relevant technologies for your digital transformation.

Would you like advanced technologies to serve your insurance business? Digitize your enterprise with KeyUA.

Contact UsInsurance Digital Transformation Capabilities

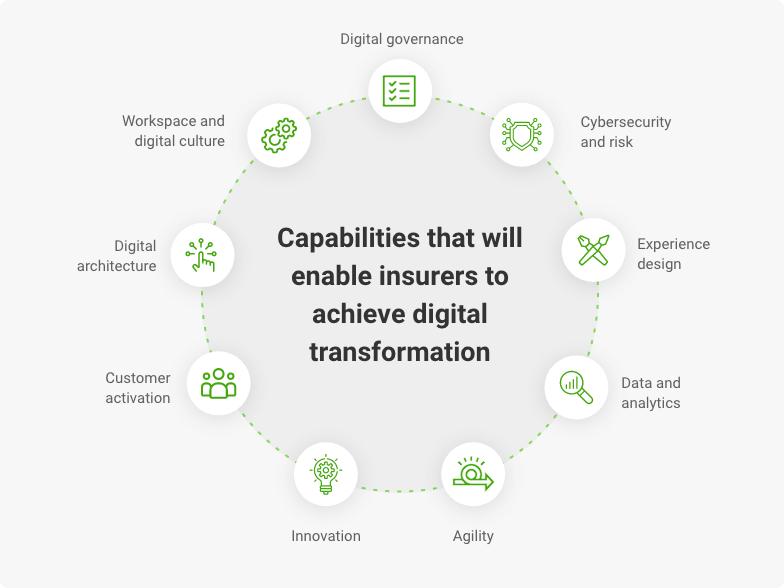

Digitizing insurance services is always about the balance between gaining short-term value with long-term evolution. The operational model transformation, investments in more precise decision-making, and discovering new customer demands should be considered for building the right digitalization strategy.

Key Capabilities for Insurance Digital Transformation

Here are the key technologies used for the digital transformation of the insurance industry.

Omnichannel Environment

Now consumers use multiple sources of information to decide what insurance products to buy. They research available offers online, discuss with friends, review relevant topics in social media. Then people purchase the chosen products via mobile insurance applications, websites, or offline. Having a wide choice of options to discover and buy products and moving seamlessly through multiple channels is vital for driving customer engagement.

Big Data Analysis

Managing the growing amount of data for analytics is now going beyond the capabilities of the human mind. Big data and predictive analysis have numerous applications in insurance, including:

- Calculating the probability of risks that are currently not covered by the insurance

- Tracking the potential customers’ needs

- Identifying changes in customer behavior and preferences

- Forming a more relevant portfolio of services for specific regions and demographic sectors

- Creating a personalized customer experience

Big data analytics allows recognizing patterns of customer behavior and discovering the opportunities for launching new products at the right moment when they are in high demand.

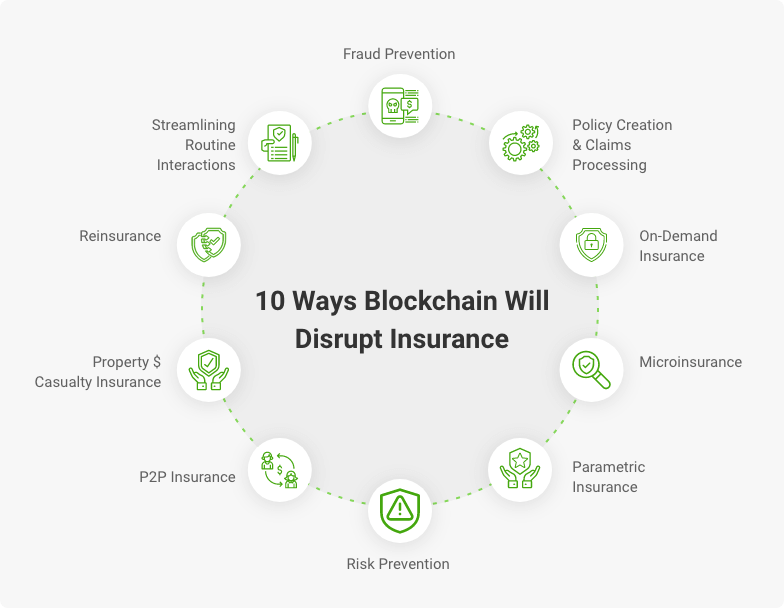

Blockchain

The critical advantage of blockchain is providing security for all information stored in it. The data is cryptographically encoded, and it is impossible to access from a single node. That is why the information can hardly be hacked or modified post factum. The critical challenge for the insurance industry is preventing fraud, including filing backdated claims. Blockchain apps help eliminate the ability to forge claim documents.

Blockchain Applications in Insurance

Another blockchain-related technology in insurance is smart contracts — digital contracts signed between two or more parties and stored in blockchain. It helps complete payment contracts without human interaction that leads to a more cost-efficient and error-free operational model. Blockchain and smart contracts are the foundation of p2p platforms for performing so-called ‘social insurance.’ A group of individuals collects their premiums to insure against specific risks without any middlemen (an insurer). This alternative to traditional insurance is becoming more and more popular, giving rise to blockchain-based P2P platforms.

Distributed ledger technologies (DLT)

DLT is often mentioned in tandem with blockchain, as these technologies are related and mainly used together. DLT platform serves to record data in digital format and shares its exact copies across several parties. The recorded information is stored in a ledger that is distributed or shared inside the network. Thus, the technology provides complete traceability and auditability of data involved in insurance processing, eliminating fraud risks.

Distributed ledger technologies ensure consistency, transparency, and synchronization of the stored information. In addition, it provides secured and fast interaction during insurance transactions with no limits to the physical location of the parties. All that results in effective claims settlement with minimum risk of fraud.

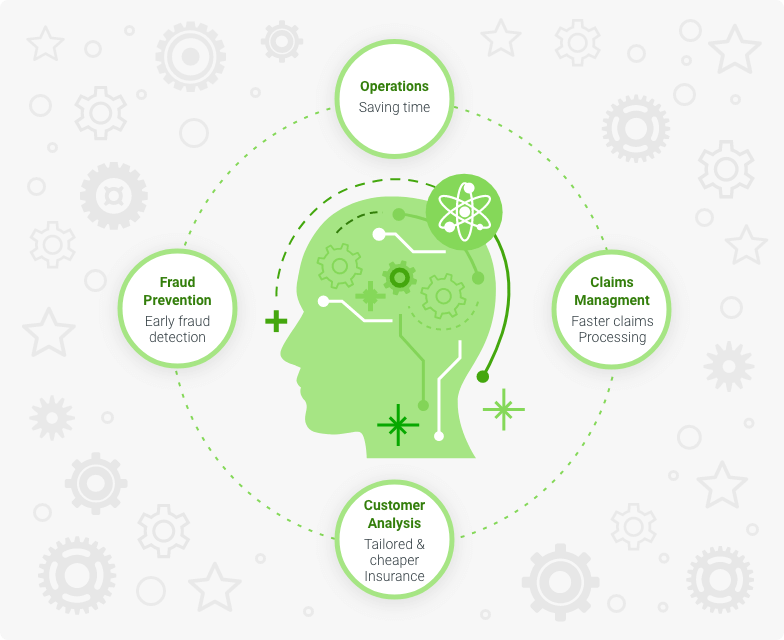

Artificial Intelligence

AI is a set of digital technologies designed to attain objectives that usually require human intelligence. By replacing human intelligence with digital in the insurance industry, it becomes possible to gain ultimate performance speed and accuracy.

Artificial Intelligence in Insurance

The pool of AI-related technologies includes machine learning, deep learning, neural networks, and natural language processing. They bring the following opportunities for the insurer:

- Tracking fraudulent behavior patterns

- Reducing fraudulent claims

- Providing automated customer support with chatbots and virtual assistants

- Automating data assessment and processing

- Reducing costs and improving quality for claims settlement

- Simplifying authorization and authentication processes through face and voice recognition systems

- Providing more relevant and personalized services to individual customers

- Lowering costs for numerous operations within the insurance cycle

It ought to be noted that adopting AI technologies raises new potential cybersecurity and privacy threats. In addition, it leads to unknown reputational risks and legal liabilities if not carefully governed.

Internet of Things (IoT)

The IoT opens new competitive fronts and opportunities for insurers. For example, the ability to monitor water pipes, heat sensors, and other smart appliances help predict accidents and break-ins before causing damages to home and commercial properties.

Building new insurance products based on these capabilities would be the right decision for expanding the consumer audience. Offering different policies for smart homes, individualizing the insurance rate, and implementing the preventive function of insurance through the IoT will increase the insurer’s value for consumers.

IoT popularity is growing in consumer and industrial sectors, and insurers have to adopt personalized services for such clients.

Telematics

Telematics is often grouped with IoT. However, telematics sensors and devices currently have a more comprehensive range of applications through different spheres. The data recorded from these devices are essential for more precise underwriting and claims management. Here are the primary uses of telematics in insurance:

- Tracking the driver’s behavior in real-time for auto insurance

- Fitness trackers used for life and medical insurance

- Warehouse monitors, fleet management, security alarms for commercial insurance

- Smart appliance sensors for home insurance

Telematics is used for usage-based insurance that is also called the ‘pay-as-you-go’ model. You can provide pricing for your services based on the actual usage and life habits of your digital customers, offering specials and discounts based on distance driven, secure speed driving, etc.

The telematics data also can be used to reduce claims fraud. Shortly the telematics-driven processes are likely to become standard for most insurers.

The above technologies do not limit the range of digitalization capabilities for insurance. This financial sector traditionally perceives and adopts innovations slower than many others due to the specificity of operations. However, most leading companies either realized the importance of digital insurance transformation or started implementing their digitization strategy reaping the benefits of the adopted steps.

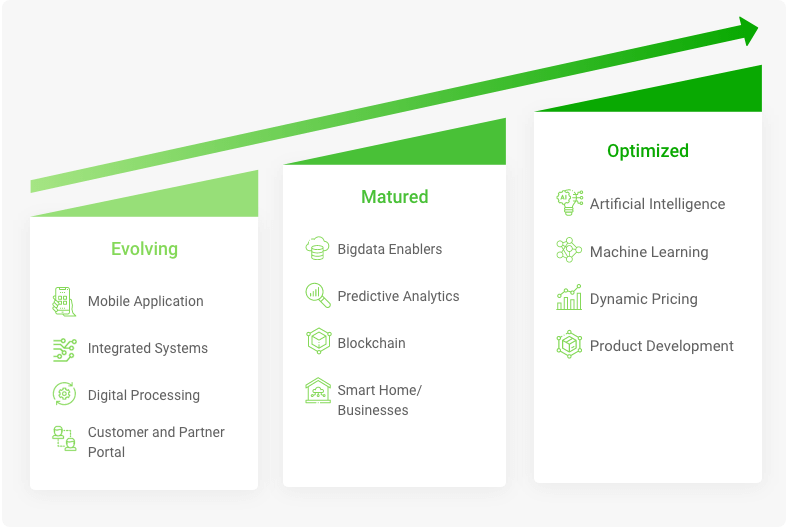

The Phases of Digital Transformation in Insurance

According to a Deloitte survey, 7 of 10 insurers stated that they have already started the digital transformation of their businesses. The online underwriting process has already brought about 30% higher efficiency with 45% Year-Over-Year net income growth. Significant improvements always start with smaller steps, and the entire roadmap of digital transformation in insurance looks like the following:

Phases of Insurance Digital Transformation

Evolving phase implies realizing the potential of digital transformation and the first steps for automating insurance processes and modifying the business model towards modern requirements and commercial goals. The critical actions within the initial phase are digitizing operational processes and creating omnichannel digital space for customer experience.

Mature stage begins after the company clearly has defined its digitizing purposes and created the basics for more advanced technologies to be adopted. Big data, blockchain, and other tools for data processing, analytics, and risk management are integrated during this phase.

Optimized stage is more about working on futuristic solutions with long-term value addition. Advanced data and analytics capabilities like machine learning, artificial intelligence, real-time predictive analysis are adopted to drive efficiency and discover directions for further development.

Implementing any improvements starts with assessing specific needs and determining suitable solutions and potential partners in the InsurTech landscape. Then, after prioritizing investments, planning the resources, and producing the implementation plan, the company begins its execution by adopting the chosen technologies and tools step-by-step.

The process of digital transformation is continuous. The technologies evolve, and the insurance market changes together with consumers’ behavior and expectations. Therefore, the insurance enterprise needs to keep up with the times to stay competitive and effective for both consumers and stakeholders.

Final thoughts

Today’s technologies evolve much faster than the slow-moving insurance sector. Most large-to-small insurance providers have already started their digital transformation or realized an urgent need for a proactive technological upgrade. One of the biggest challenges of insurance digital transformation is the lack of skills, hands-on experience, and a coherent view of the industry's key technology trends.

KeyUA software experts are ready to clear these barriers. We help insurance companies pick up the digitization pace and make technologies serve their progress.

Need a technological upgrade of your insurance business? KeyUA will help you achieve your goals.

Contact Us

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Comments

Leave a comment