Regardless of the industry and the business project size, there is always a need for an effective financial management solution. There are several ways to go - from using Excel spreadsheets to personal finance software development. Obviously, the latter option has more room for improving business efficiency, especially if your solution is cloud-based. Below are our practice-proven tips that will help you make a cloud-based financial software that will revolutionize your financial management experience.

What Is Cloud Finance Software?

In order to define cloud finance software, it would be more logical to start with the cloud computing definition.

According to the Accounting System on Cloud research, “Cloud computing is a model for enabling ubiquitous, convenient, on-demand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications, and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction.”

Thus, cloud-based finance software is an application that uses cloud computing capabilities when performing its core functions. In this case, all the financial data is stored in the cloud, the application becomes accessible on-demand, and the cloud service company provides the developers with a set of tools necessary for the creation and deployment of cloud-based financial software.

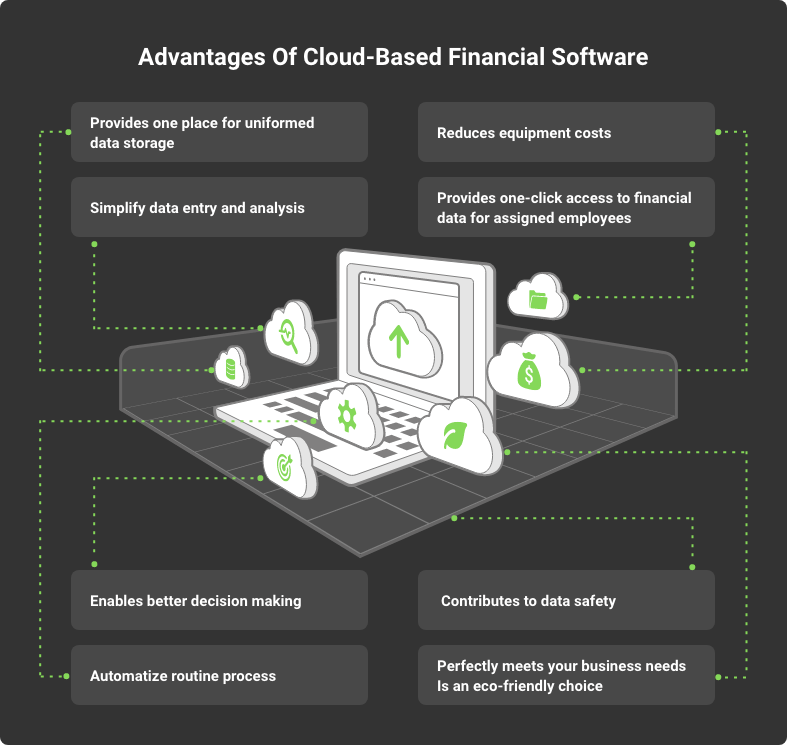

Advantages of Cloud-Based Software for Finances

If we simplify the definition of cloud finance software, we get just an application that uses the cloud to store its data. In contrast to the server or web-based application, a cloud solution has the following advantages for business.

Provides one place for uniformed data storage. If previously you have used dozens of apps for personal finance management, accounting, payroll, audit, and inventory management, moving to the cloud with the help of an all-in-one customized solution is a way to get more order and clarity in financial operations.

Simplify data entry and analysis. Any updates in your financial situations are automatically shown in the app. Plus, since all the data will be carefully structured, it simplifies the data analysis and provides you with actionable insights.

Enables better decision making. Leading cloud storage providers like Microsoft Azure may provide you with powerful machine learning development tools to empower your accounting software with artificial intelligence for better data analysis and competent decision making.

Automatize routine process. Both existing and developed from scratch, cloud-based financial software always comes with many opportunities for automatization, such as automated billings and payrolls.

Reduces equipment costs. Maintaining your own server and related equipment is a very costly and technically complex process. But when it comes to cloud computing, you don’t need any additional hardware. The only thing you are paying for is cloud storage usage, and your package can be fully customized depending on your business needs.

Provides one-click access to financial data for assigned employees. Cloud applications are developed to be accessed anytime and from any device by the authorized user. The personal financial planning or accounting software may be easily accessible from smartphones and make your staff more flexible and updated.

Contributes to data safety. Since the invention of the first cloud storage, it has become a more secure alternative to a personal server. Yes, there is a certain risk in working with cloud providers, but it does not exceed the risk of storing data on paper or your server. Plus, leading cloud providers do their best to provide absolute security guarantees.

Perfectly meets your business needs.Custom finance software can be carefully tailored to suit the specific needs of your business.

Is an eco-friendly choice. This is quite an obvious benefit when using an application instead of a pen and paper. As for the cloud apps, their usage allows you to save up to 87% of the energy consumed.

Already want to get this benefit for your business? Let’s launch your cloud finance software development right now!

Get Started TodayCloud Financial Software Types and Tips for Choosing the Right One

If you want to develop cloud-based personal finance software, the first thing to do is determine which financial app category it will belong to. Below are the main types depending on various factors.

Depending on the business necessities:

Spreadsheets. These are the simplest solutions suitable for small businesses and startups that don’t have many resources to manage and can’t afford to invest in costly software. But the set of functions will be quite limited, so this is not the best choice if you plan to scale your business in the future.

Accounting software. This is one of the must-haves for medium-sized enterprises. It comes with all the essential features to streamline the accounting process like automatic invoicing, billing, and reposting.

Inventory management application. With the help of this solution, companies may find it easier to manage their material resources and warehouses.

Payroll processing programs. When it comes to paying wages and all the accompanying taxes, payroll processing programs become real-life saviors.

Enterprise Resource Planning (ERP) system. This is a very powerful and very effective software suitable for large businesses that have stable cash flows and should be able to manage their assets and liabilities properly.

✔️So, the right choice directly depends on your business’s size, maturity, and current business needs.

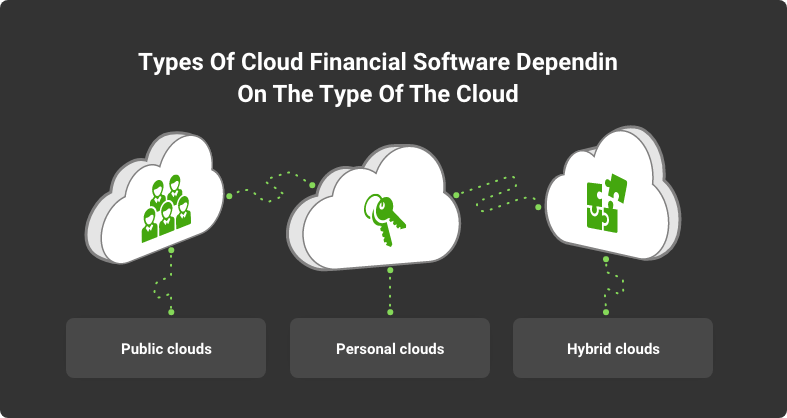

Depending on the type of the cloud:

Public. For example, Microsoft Azure is a public cloud. It means that other companies may also use the cloud storage space hosted by this provider.

Personal. In the case of personal cloud storage, no one except for the owner has access to it. For example, eBay uses personal cloud storage.

Hybrid. As for the hybrid clouds, they combine the best features of both the above. With this opportunity, you may store your sensitive data in a private cloud and still use the better operational capabilities of a public cloud.

✔️In fact, all of the options may be suitable for cloud finance applications. However, the cost per each may differ significantly, so take this factor into account. Private cloud is the most expensive, public cloud is the most affordable, while hybrid cloud cost is somewhere in between.

Depending on the approach to development and integration

Out-of-the-box (commercially available software or SaaS). These are the ready-made applications you may start using instantly after your subscription is activated. Their advantages are affordability, and each subscription package may come with a flexible set of functions. However, if your business needs to solve a very specific financial management task, it is probably not doable with the help of the software as a service.

The customized solution. This type is developed exclusively for your business necessities. Customized solutions always provide better opportunities for problem-solving and business development since they aim to help with a specific issue. Even despite the finance software development cost, it allows for saving, automating, and predictable ROI.

✔️Indeed, customized financial software is the best choice. What’s more, you may reduce its cost with the tips below and offshore outsourcing.

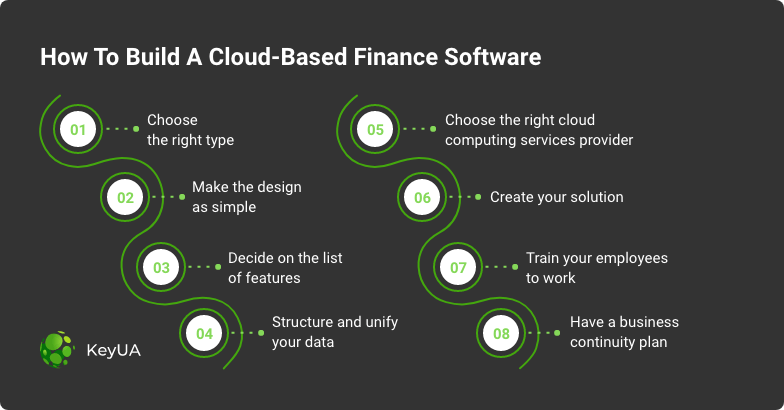

How to Build a Cloud-Based Finance Software

Below is the development process step by step.

1. Choose the right financial management software type

According to the Cloud-Based Accounting Software research, “Before choosing the software, the enterprise should answer the question of its full readiness to exploit cloud technologies, the feasibility of their implementation in comparison with the programs that are already in use, the possibilities of transforming the accounting system into a more effective one.”

To put it simply, start by defining the problem you need to solve with your software, outline the possible ways for it to work, and take a good look at your financial statements since the specific solution will have a specific cost.

2. Make your design as simple as possible

Financial management is a rather complex task, so there is no sense in making it even more difficult because of the future software’s sophisticated design. At the prototyping stage, you and your development vendor should find the perfect balance between business efficiency and ease of use.

3. Decide on the list of features

Obviously, the list of the features will depend on the type of financial software you need to create and the industry you are working in. As for the basic set, the list of features may include:

Accounting features

Payroll features

Inventory management features

Billing and invoicing features

Payments processing

Order tracking

Cash management

Tax forms and calculations

Shipping features

Reporting

Analytics and dashboards

4. Structure and unify your data before moving it to the cloud

One of the significant benefits of managing your finances through a cloud-based application is getting an entirely new way of working with your data, especially if your application is integrated with artificial intelligence functions. However, to gain insights that will be useful for your business (for example, to find out your weak points, that is, overspending and open up new opportunities for optimization), your data must be structured, classified, and brought to a single form. Usually, this service is included in your software development package, but feel free to ask your vendor this question in advance.

5. Make the right choice with the cloud computing services provider

According to the Accounting System on a Cloud research, “Providers of the Platform as a Service (PaaS) model allow developers to have access to different programming languages and tools without getting involved with the hardware environment. PaaS providers offer platforms and operating systems to applicant companies to develop, test and deploy their desired applications. Amazon AWS, Google App Engine, and Windows Azure are instances of this service model.”

At this stage, you should make the right choice with your cloud service provider. Make sure to consider the type of your future solution, the subscription cost, and safety guarantees.

6. Create your solution

This is quite a technical stage of your software creation, but depending on the dedicated development model you choose, you will be able to keep track of the progress and make the necessary adjustments.

7. Train your employees to work in a more innovative way

After your solution is ready, you need to help your employees get used to it. The software developers can provide their help with training your employees about how the features work. However, it would be better to ask whether this service is included in your development contract.

8. Always have a business continuity plan

And one more important tip! Perhaps you know that cloud operations are entirely secure, and all the data is safely encrypted. However, after you start cooperating with a cloud service provider, you become utterly dependent on his seamless work. To put it simply, if something goes wrong on the provider’s side, you will no longer be able to access your financial management app. That’s why you should always have a business continuity plan that will reflect responsive strategies in case of internet failure, loss of control over the application due to the provider’s fault, and loss of your data. Cloud providers usually provide security guarantees, but relying on yourself has never been a bad strategy.

How Much Does It Cost to Develop a Finance Software?

As always, the issue of the cost is quite individual, specific, and circumstances-dependent. The final cost to develop finance software is affected by:

your app type

the number of features you need to create

the number of users your app will support

the cloud platform provider you will choose

the cost of software maintenance and support

the cost of training for your employees

the location of your development vendor

the deadlines, in some cases.

Conclusion

So, creating a cloud-based accounting application is essential for streamlining your financial management operations. What’s more, there is a lot of room for advanced features like AI and ML integration, data analysis and predictive analytics, automatization, and customized reporting, bringing more clarity to your financial planning and strategy development.

Want to utilize all these features for boosting your financial management? Consider creating a personal accounting application for your business. Our tech-savvy team is ready to help while being only one click away.

Hire Us

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Comments

Leave a comment