Investors appreciate comfort and security, as well as the accessibility of worthy sources for investment. That’s why online stock trading is currently in the groove. The question is how to build a trading platform that will put aside today’s market winners and bring lucrative profits to a founder.

Here you will get the latest insights to know about the online stock trading industry and tips about what is currently on demand. New startups are still welcomed to the market. Find out how to create trading applications with great potential for fast investment returns.

What is a Stock Trading Platform?

A stock trading platform is a software used for executing transactions on the financial markets. Individuals can place orders for stocks via intermediaries (brokers, banks, etc.). Online trading features a few essential advantages compared to traditional offline trading:

Users can trade from any location connected to the internet;

Immediate order execution gives more precise results;

Everyone has access to specialized markets;

Extended trading capabilities (i.e., high-frequency trading);

Ability to use lots of additional tools for optimizing orders;

No personal relationships with brokers and zero emotional impact on trading activity.

Online trading platforms made stock trading accessible to anyone, significantly increasing the overall number of traders and trading volumes.

During the COVID-19 pandemic, the trading market has broken records. According to Charles Schwab’s Q1 2020 financial report, 27 of 30 top volume days in its history took place in February and March 2020.

Why Should You Create a Stock Market Application?

When choosing the direction for future business, it makes sense to evaluate prospects. Here are the main reasons to build a stock market app in 2021.

1. Online Investment Becomes More Popular

Up to 90% of US adults have investments beyond their retirement account, and 55% of them own stock, based on Gallup statistics from March-April 2020.

| Stock Ownership Among Major U.S. Subgroups, 2020 | ||||

| Yes, own stock | No, do not | No opinion | No. of interviews | |

| % | % | % | ||

| U.S. adults | 55 | 45 | * | 2027 |

| Men | 58 | 42 | * | 1052 |

| Women | 52 | 47 | 1 | 975 |

| 18-29 | 32 | 68 | * | 298 |

| 30-49 | 59 | 41 | * | 526 |

| 50-64 | 66 | 33 | * | 541 |

| 65+ | 58 | 41 | 1 | 642 |

| Non-Hispanic white | 64 | 36 | 1 | 1458 |

| Non-Hispanic black | 42 | 58 | * | 200 |

| Hispanic | 28 | 72 | * | 224 |

| Postgraduate | 85 | 14 | * | 401 |

| College graduate only | 77 | 23 | * | 462 |

| Some college | 54 | 45 | 1 | 678 |

| No college | 33 | 66 | * | 459 |

| $100,000+ | 84 | 15 | * | 501 |

| $40,000-$99,999 | 65 | 35 | * | 766 |

| <$40,000 | 22 | 77 | * | 540 |

| Republicans | 61 | 37 | 1 | 624 |

| Independents | 51 | 49 | * | 726 |

| Democrats | 56 | 44 | * | 623 |

| GALLUP, MARCH-APRIL 2020 | ||||

Note that 85% of postgraduates, i.e., solvent adults, own stock. Just imagine how big your potential audience is.

2. Online Trading Services Become More Profitable

Investors gradually move to online stock trading, using all the benefits of automated market analysis. Today’s technologies like AI and ML provide incredible prediction capabilities, continually driving humans out of the trade advisory sector.

3. Online Stock Trading Becomes Entertainment

Covid-19 made much of the world go into lockdown. People rarely go out, lots of entertainment disappears. Even online sports gambling stops, as not many sports events are happening around the world. As a result, people sitting at home are getting bored. They take out their laptop and start trading, especially those who missed the excitement of online betting.

Robinhood, one of the largest e-brokers, saw a historic 3 million new accounts in the 1st quarter of 2020, according to CNBC. Other prominent market players also reported a flood of new clients. All these statistics support the idea that online trading platforms will continue to gain popularity in the nearest future.

4. Lower Broker Commissions = More New Traders

In late 2019 and early 2020, many brokers have lowered their commissions down to zero. That caused a wave of new traders entering the online stock market. Considering the new potential pandemic wave and lockdown and other instability factors like the US election, this trend will continue in 2021.

5. Experts Expect a Bounce-Back of the Stock Market at the End of 2020 and 2021

2021 is expected to bring a new wave of stock market activities. According to Morgan Stanley, “Stocks will fall 10% before a "surprising recovery" later in the year and into 2021 pushes markets back up, Morgan Stanley analysts said this week.”

These factors make it reasonable for a startup to make a stock trading app in the next few years.

Types of the Stock Market Investment Apps

Online trading platforms are mainly classified by available assets for trading. There are two major groups:

Traditional Trading Platforms

Everyone is familiar with this type of trading. The available assets include stocks, options, currencies, ETFs, precious metals, etc.

Traditional online trading is still the most demanded. People understand better how to deal with conventional assets. Also, there are more training materials and tools for analyzing traditional stock markets than newer, cryptocurrency markets. This trading segment is more prominent and more popular among the 30 and older categories.

Crypto Trading Platforms

These platforms allow interchanging between different digital currencies or exchanging cryptocurrency to fiat currencies. It is a comparatively new trading segment, which appeared only a few years ago. Here you can trade Bitcoins, Litecoins, Ethereum, and many other digital currencies. There are centralized and decentralized types of crypto trading. The first one is held via brokers, while the second one works in the Peer-to-Peer model.

Many experts admit that investing in cryptocurrencies will be a good strategy for 2021. This market is very dynamic and inspires people to earn profits on regular price fluctuations.

Have an idea of how to capture the market with a new stock trading application? Don’t put it off until tomorrow. Start its development right away!

Estimate The ProjectHow to Monetize a Stock Trading Application?

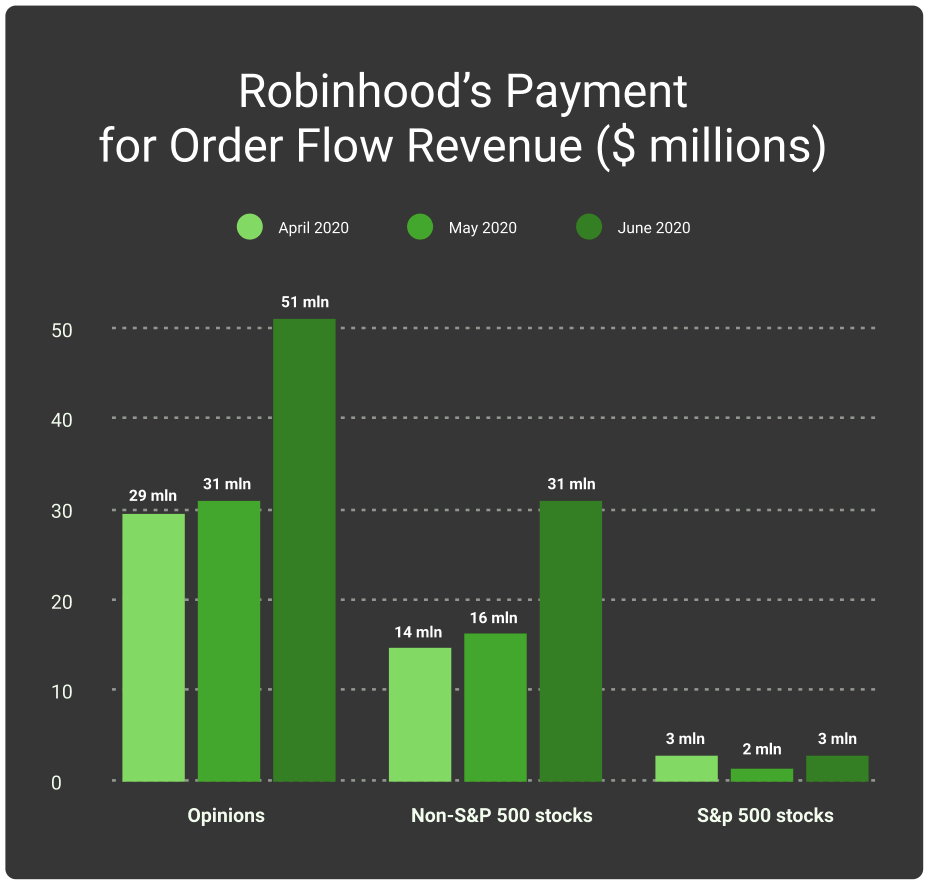

The market leaders like Robinhood offer commission-free trades. However, in the Q2 2020, the platform made $180 million revenue:

Revenue doubled compared to Q1 2020 when Robinhood made $91 million. So, how to make money on commission-free trading? Robinhood has a few significant sources of revenue:

Routing buy and sell orders to large trading companies for execution. Trading firms pay online platforms for the right to execute trades and earn on transactions.

Options: these are complex securities that allow users to buy and sell a stock at predefined prices. They imply higher risks and potentially bigger gains.

Premium features: an upgrade of an ordinary account with additional tools for trading. As a rule, these are more-in-depth market statistics and access to the Level II market data for more precise trades.

Collecting interest on users’ deposits and securities they hold on their accounts.

Lending out idle cash to investors to make interest.

Paid trading services. For instance, Robinhood charges for live broker trading by phone or for executing foreign transactions.

Robinhood was founded in 2013, and these monetization strategies have brought the company stable earning growth:

| Robinhood Revenue | |

| 2015 | $2.9 million |

| 2016 | $9.3 million |

| 2017 | $21 million |

| 2018 | $69 million |

| Q1 2020 | $91 million |

| Q2 2020 | $180 million |

Source: https://www.businessofapps.com/data/robinhood-statistics/

Best Stock Trading Platforms in 2020

If you’re planning to build a stock trading application, be ready for high competition. Research your competitors to define trendy features, technologies, and marketing approaches. Here are a few popular platforms with a website and mobile apps, which is now a standard in online trading.

#1. Robinhood

As described above, Robinhood offers fee-free trades. The user doesn’t pay anything for the deals they make. This platform is primarily focused on mobile users, and its mobile app was released even before the website.

Since 2013 its mobile platform has become one of the most polished and handy for use. It provides extensive resources regarding the global stock market and detailed trading reviews. It is also called the best app for tracking the stock market. The main features include:

Stocks, options, ETFs, cryptocurrency trading

User portfolios

Real-time market data and charts

Watchlist

Alerts

Detailed stock review

Market news section

Various money transfers

Smartwatch sync

#2. E-Trade

It is Robinhood’s #1 competitor and the first online stock trading service on the web. It offers a wide variety of securities for investment. However, it still has a commission fee, one of the highest in the industry.

E-Trade is now represented by two platforms: the original one and the new app called Power E-Trade. Both have website and mobile (Android/iOS) versions. The key features include:

Stocks, ETFs, mutual funds, and options trading

Touch ID authorization

Live market statistics

Portfolios

Alerts

Watchlist

Trading news

Educational tools

Money transfers

Customer service chat

#3. Acorns

Acorns is a new type of app for investors and traders called robo-advisors. A user fills in information about themself. Based on this info, the system defines five ETFs collections a user can choose. Then you just deposit money, and the trading starts automatically. Acorns focuses on those who don’t want to be involved in trading much but have extra money to invest to gain additional earnings.

If you are wondering how to make an automated trading system that will become a market leader, take a look at Acorns features:

ETFs trade only

Automatic roundup: each purchase is rounded up to the nearest dollar, while the rest is added to Acorns Round-Up balance.

Scheduled deposits: daily, weekly, monthly

Found money: when shopping with Acorns partner brands, extra money is added to Acorns account

Acorn Later: investing in an individual retirement account (IRA)

Chat customer support

Each platform has unique competitive advantages that set it apart from competitors. It shapes your presence on the market, your audience among all traders.

The Essential Features of a Stock Trading Platform

The list of possible features for an online stock trading platform is virtually endless. Here is the basic set of features for trading online based on what today’s market leaders offer their users.

Check-in: an authorization interface that lets a user in the system and gives access to trading-related and personal data.

Profile page: here, a user manages personal information.

Online dashboard: a visual representation of trading information, user’s deals, statistics, etc. Here, users can track their trade history, check the current securities offers, and collect data for future trading decisions.

Placing trades: the main activity on the platform. Here a user places trades with the ability to edit all related data.

Payments and transactions: users need to deposit money to their platform account and withdraw earnings from it.

Real-time stock quotes and chart streaming: each trader has to track the market for accurate analysis and building trading strategies.

Watch lists: a statistical tool to track individual stocks or other securities to pick sources for investments. It usually shows the user's price, volume, bid price, and percentage changes.

Newsfeed: this is a part of an app for monitoring the stock market. A trader has to keep up with the latest news from the industry, politics, economy, society, and other areas to make the right trading decisions.

Stock notifications: a user must be alerted about changes in bids and prices they are currently tracking for reacting fast.

Website vs. Application: I’ll Take Both!

According to Statista, in the Q1 2020, 51.91% of global website traffic was generated by mobile devices (excluding tablets). It means you need to make your future platform comfortable for mobile users.

There are two options: you can develop a responsive site or a separate mobile app. Statistically, the second option is better. The latest report from Sensor Tower shows that over the first half of 2020, users spent $50.1 billion on mobile app downloads and installs. It is 23.4% more than in the first half of 2019.

When it comes to a choice, which is better to develop – a stock market website or application, the answer is obvious: you need both. Giving users options for any device makes sense. Most traders use online platforms from both a computer and a mobile phone, and many prefer tablets.

If you need to choose between a responsive website or a mobile app, let’s consider the advantages of both:

Responsive website | Mobile app |

|

|

Speaking out of technical aspects, the marketing success of such platforms highly depends on reputation. It’s positively weird in the modern technological stage to offer such a service with a website only. Even if you are currently limited in budget, it is better to start from a mobile app than a website, as Robinhood did.

What Do You Need to Develop a Stock Trading App?

It is a long voyage from generating initial ideas to your first release on the market. Start with the research: check the look and feel of competitors’ solutions and define your target audience. Based on that, figure out a list of features for the future platform. Then move to technical preparations.

Choosing a Platform

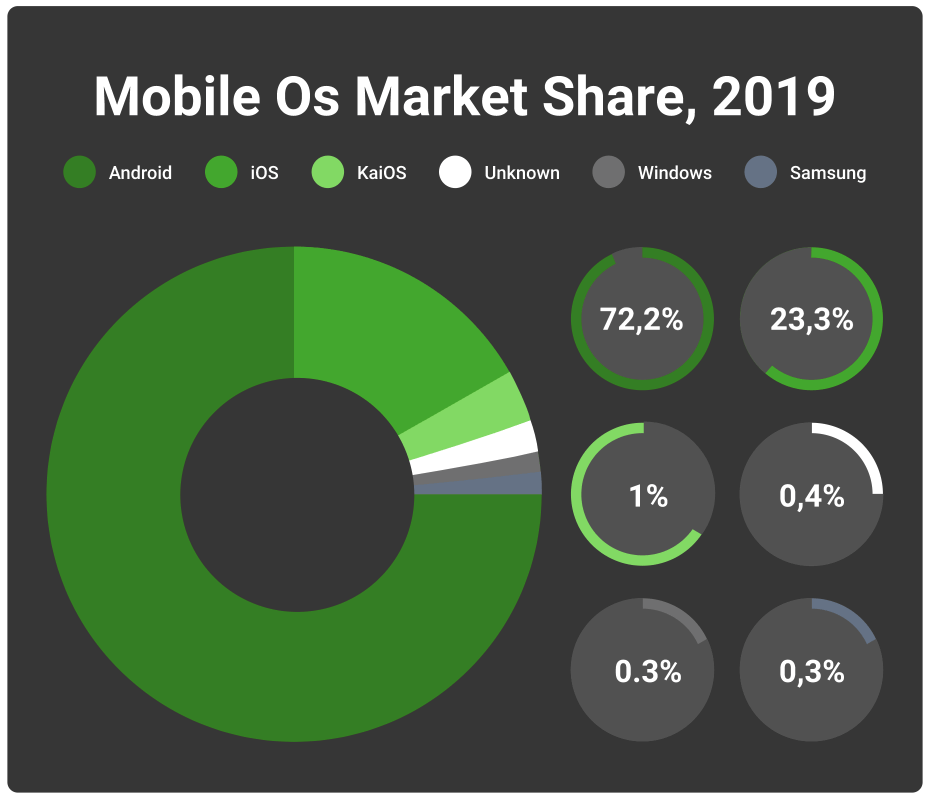

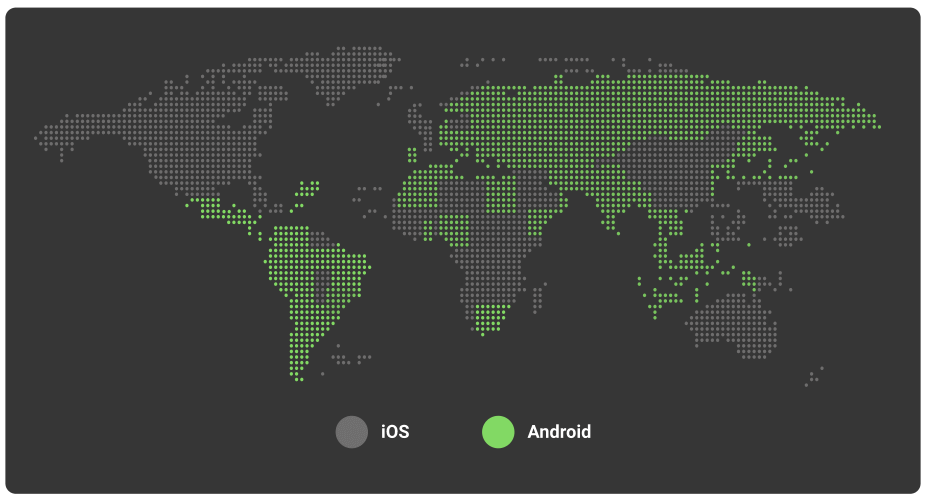

There are two leading mobile platforms used globally: Android and iOS. The 2019 statistics show that Android occupies a much more significant portion of the mobile OS market share:

The situation hasn’t changed much in 2020. And at first sight, it seems obvious: if the budget is tight and you need to choose only one mobile OS to start, Android is the right choice. That is not correct. The right choice depends on the target audience. You need to check what OS is more prevalent in the countries you’re planning to operate. Take a look at this figure:

If your future service is oriented towards Europe, it makes sense to start with Android. If you’re looking towards the US market, go for iOS.

Hiring the Development Team

Creating custom trading software from the ground-up requires the following specialists:

Backend developers. The core of the app is its architecture, database, and logic. Backend programmers are responsible for this part. Depending on the project scale and the deadlines, you may need 2 to 5 back-end developers specializing in the technologies you chose.

Frontend developers. The frontend is the visual shell of the application, its user interface. Front-end developers are responsible for coding the design layouts and connecting them to the back-end for proper data visualization. They use HTML/CSS, Javascript, and various JS frameworks.

Mobile developers. iOS and Android programmers develop the mobile application. Depending on the chosen OS, you may need specialists in Java, Swift, C#, Kotlin, or other technologies.

Designer. A designer creates UI/UX of the future platform, all graphic elements of the interface.

Project Manager. The PM coordinates the entire project, defines the scope of work for each team member, splits the development process to milestones/sprints, and controls the deliverables on every stage. They also report progress to the client and transmit requirements and expectations to the development team.

QA engineers. They take care of testing the performance, the look and feel of the product. They fix any issue before the platform goes to production.

Looking for a team to develop your Fintech project? Get the best software development engineers!

Reach Our ExpertsUI/UX Design: the First Step From an Idea to a Product

The design of the user interface, in many respects, defines future platform success. The UI/UX design starts with creating wireframes based on the features and usability requirements. There can be a few iterations of wireframing. Each one utilizes feedback from a client, user groups, back-end, front-end, and mobile developers.

After the wireframes are polished, and everyone is happy with them, the designer starts creating graphic design.

Legalities

Various legalities firmly control the brokerage market. When you make a stock market app, take care of proper licensing and compliance with regulatory bodies and laws.

You will need to obtain a license in all countries where you’re going to represent your trading platform.

Your business will be monitored by the proper regulatory body (for instance, it is the Securities and Exchange Commission (SEC) in the USA).

To get a strong reputation as a reliable stock trading service, partner with various regulatory authorities (a trading platform like E-Trade partners with Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC) in the USA).

Time and Money to Create a Trading Platform

Here is a rough estimation of the entire project scope you can use as a reference to estimate the timeframe and budget.

Stage | Time, hours |

Website Development | |

Setup infrastructure | 16-48 |

Design | 400 - 600 |

Frontend development | 496 - 1200 |

Backend development | 448 - 872 |

Admin panel development | 120 - 172 |

QA | 80 - 120 |

Release and Production | 40-72 |

SUBTOTAL: | 1604 - 3084 |

Mobile App Development | |

Setup infrastructure | 16-48 |

Design | 400 - 572 |

iOS development | 872 - 1616 |

Android development | 872 - 1616 |

Backend development | 488 - 872 |

Admin panel development | 120 - 200 |

QA | 80 - 120 |

Release and production | 40 - 72 |

SUBTOTAL: | 2888 - 5116 |

TOTAL: | 4492 - 8200 |

Assuming developers’ average hourly rate is $35/hour, the estimated cost of the mobile app development is $101,080 - $179,060, and the website platform is $56,140 - $107,940. The total stock trading app development cost is $157,220 - $287,000.

Takeaways

Online stock market app development is, by all means, a worthy investment in 2021 and beyond. Within the upcoming flow of new traders and innovative computing technologies, it will bring significant returns. But only if it is done right.

If you have an idea for your own online stock trading startup and need to build a powerful platform for a successful start, you will need a reliable, forward-thinking development partner. We are fond of Fintech and have extensive experience in creating and maintaining software products for trading. We are happy to deliver you an innovative, highly reliable, and functional stock trading platform.

Considering the idea of building a powerful trading platform? Consult KeyUA Fintech experts to choose the right technologies and start the development right away!

Get A Free Quote

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Comments

Leave a comment