Digitalizing the insurance business is a win-win trend that helps optimize the provider’s resources and customer experience. For example, an insurance company can reduce the cost of processing claims and bring convenience to its customers by building a car insurance application. If these are your objectives, find out how to create a customer-centric product for your car insurance business.

The Reasons To Build a Car Insurance App

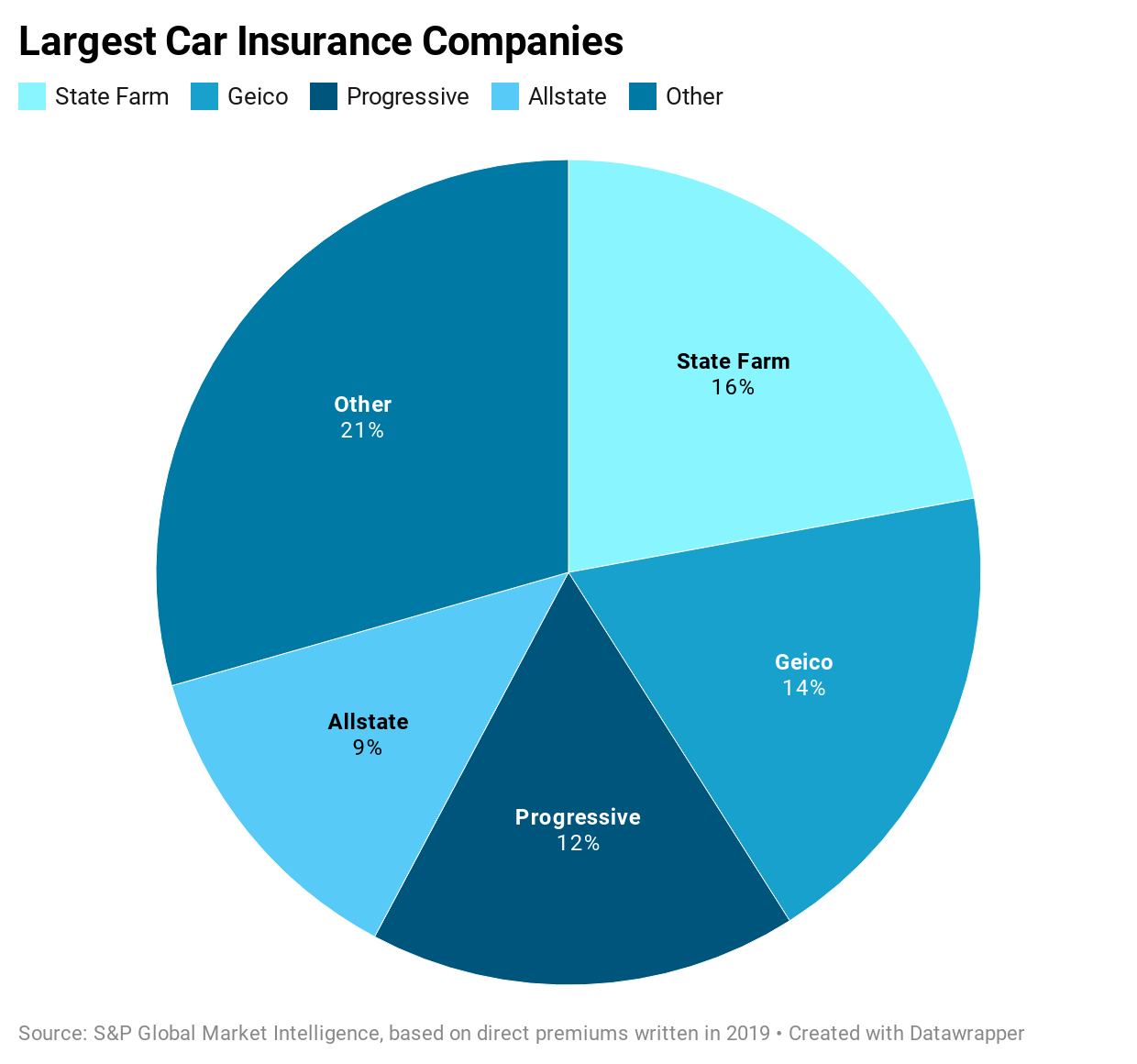

In the USA, there are nearly 6,000 insurance companies. According to Forbes, the TOP 10 car insurance providers control 73% of the country’s market.

Largest Car Insurance Companies in the USA (Source: www.forbes.com)

Alongside competitive pricing and intelligent customer service, all of them have car insurance mobile apps. It is one of the most efficient ways to provide insurance services to mobile-oriented users that bring valuable advantages:

- An app makes communication between an insurance company and its clients faster and more effective.

- It automates most of the tasks commonly performed by insurance agents, saving the company resources and eliminating various errors due to human error.

- It helps reduce operational costs on customer support and claims processing.

- Creates an additional channel for acquiring new clients by advertising the app in various industry-dedicated sources.

- Allows collecting more information about clients for analyzing their behavior, needs and finding efficient opportunities for business development.

Moreover, a comprehensive car insurance app assistant can become a decisive competitive advantage for your company to fight market rivals. The success of car insurance app development depends on the chosen features: it should become a real helper for a user on the road.

1. Define The Car Insurance App Type

The car insurance industry is rather tricky in terms of managing and connecting all parties within a single system. There are three leading roles in the insurance circle:

- The insurer (the insurance company)

- The insured (end-customer)

- The providers of services that are covered by insurance (mainly car repair services and hospitals)

Each party requires an efficient digital tool to cover their specific needs and manage their part of the process. Creating a single app for all with multiple user roles is somewhat tricky. It contradicts the primary goal of auto insurance app development — simplification. That is why usually there are three different app types used in the car insurance business:

- A client app: the one that clients use to manage their insurance policy, make and process claims, and communicate with the insurer.

- An agent-side app: an admin panel for insurers to manage policies, quotes, claims, track the clients’ history, etc.

A service provider app: car repair and healthcare providers use the app to process orders, report on order status, raise invoices, and receive payments.

3 Different Types of Car Insurance Apps

Often the features of the latter two app types are implemented using CRM and ERP solutions that are more cost-efficient. If you need to create a car insurance app for clients, it makes sense to choose custom development. The service convenience and pricing are two vital factors that customers evaluate when choosing the insurer. That is why your app needs to stand out from the rest in both comfort and performance.

2. Choose the Development Approach: Web or Mobile?

The choice of technology highly depends on the app type and the way it will be used. Here are a few reasons to build a car insurance mobile app for clients:

- As a rule, clients need interaction with the insurer during critical situations while driving a car. Logically, they need quick access to the insurance app. It is more convenient to hit the app icon on the home screen than enter the website URL in a mobile browser.

- When driving a car, the only available device is usually a smartphone. And 9 in 10 smartphone users prefer using a mobile app rather than a browser.

- A mobile app usually requires entering access details once. So, a client won't have to remember the password and other credentials in an extreme situation.

- Mobile apps allow sending clients push- and in-app notifications to report the claim status, remind them about renewing the policy, give valuable recommendations, etc.

A mobile app is a preferable option for insured customers. It brings higher convenience and simplicity than a web app. However, a web interface can suit employees if your company agents work primarily in the office. A web app can be used from mobiles, too, for those who work on their feet. Yet, there can be a problem when trying to access the history data without an internet connection.

Cannot define what development approach fits your car insurance app requirements? Consult KeyUA experts.

Contact Us3. Review Competitors: TOP 5 Mobile Car Insurance Apps

Review the best samples of auto insurance app development available on the market to see what made them successful among customers.

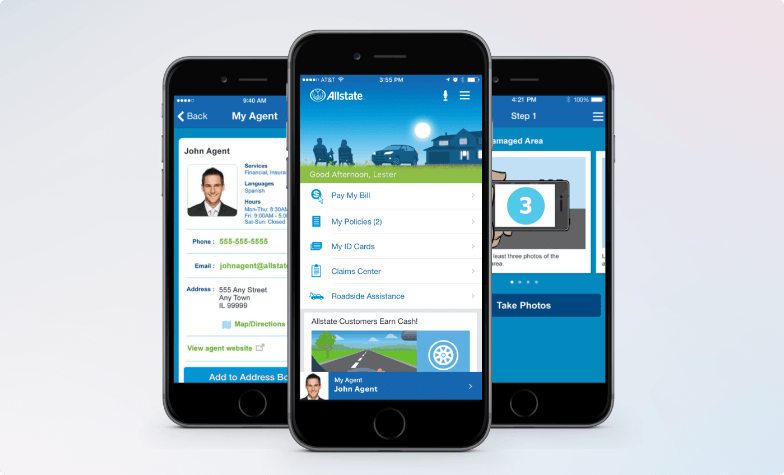

#1 Allstate Mobile

The mobile app from Allstate company is a real helper for its clients with auto insurance. The application allows submitting claims, finding an agent, and receiving roadside assistance. In addition, it features a gas finder to prompt where a driver can fill up the car and a parking locator to show the available parking options in the supported areas.

Allstate Mobile Screens

In 2020 the company also released its Drivewise application. It features a comprehensive system for analyzing the driver's behavior on the road and giving prompts to improve driving safety and performance. Drivers can earn significant discounts on their auto insurance by improving their driving habits.

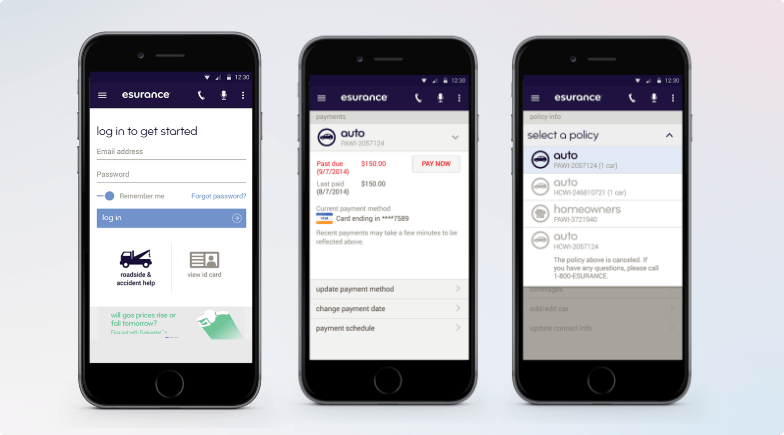

#2 Esurance Mobile

Esurance company decided to focus on basics within their mobile app to offer standard features required for using your insurance options:

- View the policy information and other documents

- File a claim

- Change the payment method

- Pay the bills

- Roadside assistance app features

Esurance Mobile Interface

It is a straightforward mobile application requiring minimum time to use all insurance services under the client's policy.

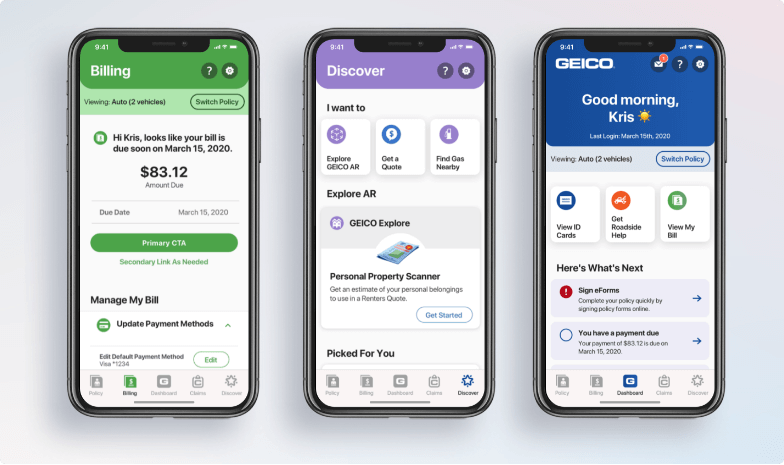

#3 Geico Mobile

Geico is one of the biggest insurance companies in the USA. The company decided to create a car insurance application in 2011, among one of the first insurers going mobile. Today, Geico Mobile is available for both Android and iOS platforms, offering the following features:

- 24/7 access to an insurance ID card with the ability to add it to Apple Wallet

- Tow and car emergency app features

- Submit photos and get a quote for repair with no appointment at an auto shop

- Consult an insurance agent in the native Messages app

- Consult GEICO Virtual Assistant (bot) regarding all insurance-related questions

- Create a car maintenance schedule and view the car service history.

GEICO Mobile Interface

Geico Mobile utilizes advanced functionality like an AI-based chatbot. It has 24/7 instant access to all the company’s services for customer care and a 4.8 rating in both App Store and Google Play that proves its efficiency for users.

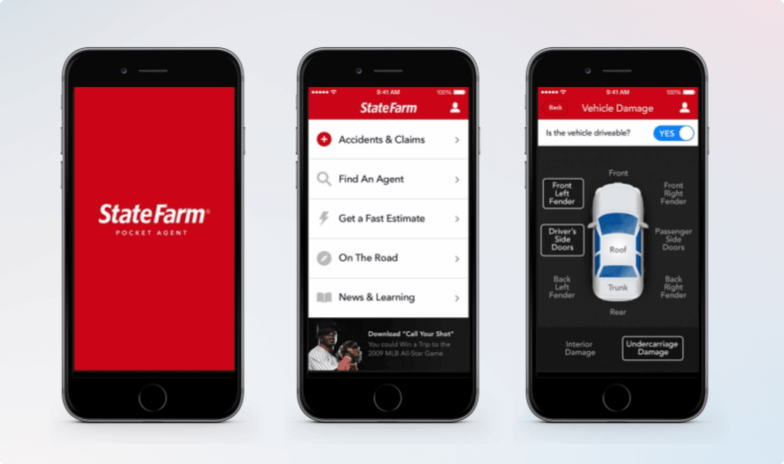

#4 State Farm

State Farm Pocket Agent uses Material Design and features the essential car insurance basics: access to ID cards and other documents, a claim center to file claims, load photos, and get quotes. It also helps users find required roadside assistance, pay the bills, and manage an insurance policy. A client can also connect with an insurance agent through the app to consult in real-time.

State Farm Pocket Agent

Additionally, State Farm allows tracking the driving to earn discounts for the car insurance. The application is ranked #48 in the App Store’s Finance category.

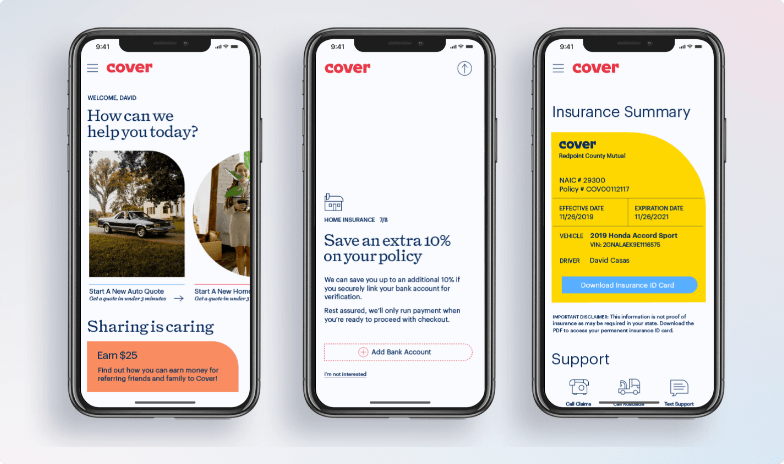

#5 Cover

The Cover’s mission is to make insurance simpler in every possible way. Its mobile application is one of the biggest time-savers in the niche. This application uses an artificial intelligence algorithm to match the user’s requirements with available insurance offers from 30+ partnering companies to find the best matching policy.

Cover Mobile App Screens

It automatically compares multiple insurance products, outputting the most affordable coverage for the stated parameters. The app also allows users to consult a human car insurance advisor.

4. Define Features for Your Auto Insurance App Development

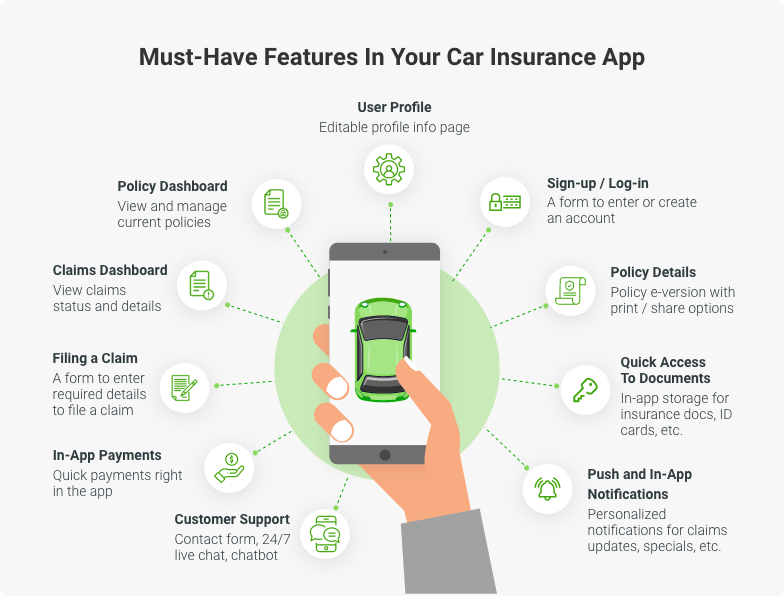

A mobile app for clients should work as a time-saver, giving instant 24/7 access to all the company’s services and products. While you can enrich the user experience with multiple add-ons, there are essential features to start with when you decide to develop an app for a car insurance company.

The Main Features for Car Insurance App

1. Sign-up / Log-in

It would be better to offer a few sign-up options for the user's comfort, including registering via a mobile phone number, e-mail, etc. Some users may not already have an insurance card ID when downloading the app. That is why using insurance ID credentials for registering an account may be the wrong solution. Make sure to use all available mobile-specific authentication methods like FaceID and TouchID to access documents or financial data inside the app.

2. User Profile

The user profile screen should contain all information about the insured vehicle and the basic data about the owner. In addition, it should allow editing profile details and giving a quick view of the enabled insurance policy, rates, claim history, and other activity performed by a user.

3. Policy Details

This screen should be a digital version of a printed insurance policy. Here a user can review the terms of their active policy or show it for inspection if needed. Some apps also have a button to print out the document, save it in PDF, or send it via email.

4. Policy Dashboard

If your company allows clients to select the type of insurance policy or change to another without visiting an office, it makes sense to include this feature in a mobile application. For example, think about providing the list of available policies with filters by vehicle parameters, desired coverage terms, etc. Another approach is sorting out suitable policies based on the profile details.

5. Filing a Claim

This is the core feature that clients usually use a mobile car insurance app for. If the insured event occurs, a user needs to file a claim from their mobile device quickly. For example, in a car accident, a user needs to enter all required information quickly and upload photos to evaluate the damage.

6. Claims Dashboard

A user needs to track the status of their claims in the app. Insurance companies use AI and ML-based algorithms to reduce manual effort and human-related issues to speed up claims processing. The dashboard should contain the list of claims, active and past, showing their status and details, attached photos, and videos.

7. In-App Payments

Users should have the ability to make any insurance-related payments right from the app. For example, a payment section usually allows choosing preferred payment methods, entering payment details, and setting up auto-payments for renewing the policy.

8. Quick Access To Documents

Carrying paper policies, ID cards, and other documents has become history. Let a user upload and access all relevant e-documents with a tap. Make sure they’re securely stored on a smartphone and cannot be accessed by any third parties.

9. Customer Support

24/7 support can be provided by standard phone calls and live chat options with consultants and AI-based chatbots. The most common time for car accidents are early morning, late night, and the afternoon. It is critically important to keep in touch with the customers wherever they need assistance from the insurer.

10. Push and In-App Notifications

Don't make users go to the app every time they need to check the status of claims or see the date when the policy renewal is required. Instead, use push notifications to inform users about all critical updates, available discounts, and personalized tips for optimizing their experience. In-app notifications work great to guide a user through correct claim filing, new messages in the support chat, some traffic, and roadside assistance information, etc. Both notification types should be optional to let the user decide whether they want to receive them.

These are the basic features used to build car insurance apps for end customers. However, to stand out from other similar apps, the next step can be providing more assistance to drivers on the road. In addition, it may improve loyalty to your company and significantly increase user engagement.

Would you like to know how much time it may take to develop your car insurance app? Send us your project requirements.

Get A Quote5. Ways to Make Your Car Insurance App Stand Out

The insurance business is a rather conservative niche that doesn’t have too many options to stand out. Yet, any customer is always willing to get more value from running the app. There are three main ways an insurance app can help users feel more loyal and engaged while using it:

- Money-saving add-ons: advice for less fuel consumption based on driver’s behavior, displaying the cheapest gas stations nearby, rewards system for safe drivers to earn bonuses and discounts.

- Time-saving add-ons: faster claims processing, itinerary tips to get to the destination using the best available route, in-app access to roadside assistance.

- Safety add-ons: tips for safer and more efficient driving, informing users about any accidents or jams within their route, ability to track teenagers on the road by their parents, etc.

3 Steps to Make a Car Insurance App Stand Out

Here you can utilize advanced technologies like machine learning to analyze the users’ behavior and produce personalized tips and other content. However, it may also involve integrating numerous APIs to access data from third-party services, GPS, etc. As a result, it may raise the app development cost yet engage customers to use it longer and more regularly.

6. Define The Tech Stack

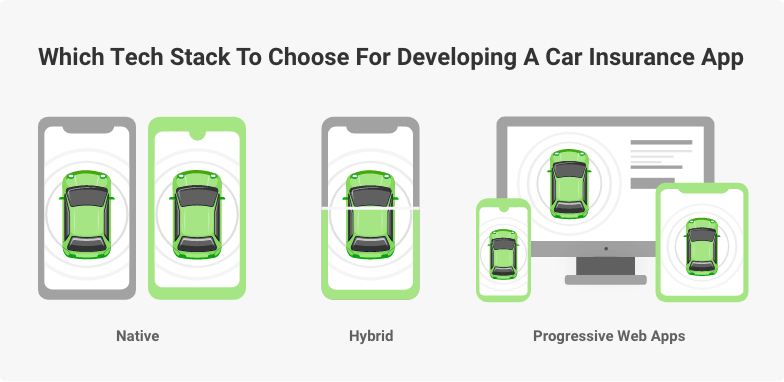

There are multiple ways to implement the mobile-focused customer solution. To create your own auto insurance app, first, you need to define the technological approach that fits your project requirements. Then, you can choose one of the following technologies:

- Native: it involves writing native app versions for each supported platform. Usually, these are Android and iOS. Programmers mostly use Java for Android development and Swift for iOS. It is the smoothest available way to use all platform-specific capabilities and design elements, providing the fastest possible performance. However, it requires writing and maintaining two separate codebases that affect the cost.

- Hybrid: this approach implies rendering a single codebase within app containers for different mobile platforms. Ionic, React Native, and Flutter are the most popular technologies. All of them have certain limitations in performance and provide a similar look and feel of the app on various mobile platforms. The choice of a specific hybrid framework depends on the project requirements and developers’ qualifications.

- Progressive Web Apps: these are cross-platform web applications that bring native app-like user experience using web browser APIs and features. PWA doesn’t allow access to certain mobile device functionalities like NFC or calendar. If your future app needs to use the device hardware extensively, it would be wiser to choose native app development.

Choose the Right Tech Stack for a Car Insurance App

Developing a mobile application for a car insurance company usually requires extensive use of APIs to access data from the company’s CRM system, service providers, user’s geolocation, to manage payments, process graphic files, and a lot more. Here is a list of commonly used integrations for insurance projects:

- Stripe API for in-app payments processing

- Vehicle Status to track vehicle data

- Google and Apple Maps for roadside assistance

- Google Roads API to track the allowed speed range for the specific area

- Twilio for built-in chat features

- DocuSign for digital documents signing

The list of required APIs may vary depending on the specific needs of your project. However, they help save development time by providing ready-made solutions instead of writing the code for particular functionalities from scratch.

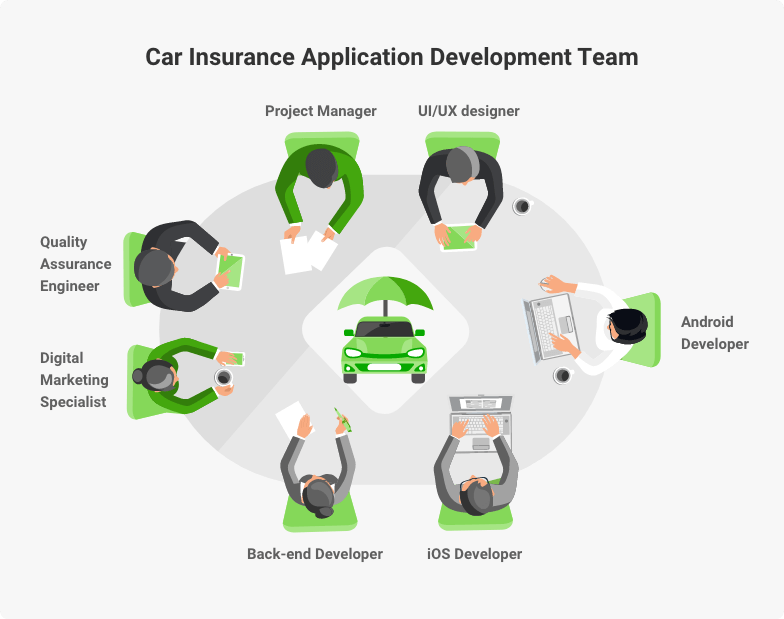

7. Hire a Development Team

The most popular approach to create car insurance apps is native mobile app development. If you go this route, a team for the project should include the following specialists:

- 1 project manager

- 1 - 2 back-end developers

- 1 UI/UX designer

- 1 Android developer

- 1 iOS developer

- 1 - 2 quality assurance engineers

- 1-2 digital marketing specialists

Choose the Right Development Team to Build Your Car Insurance App

This team will perform the initial research to define the project scope and estimate its cost. Then they will design the UI, develop front-end and back-end parts, and compile both iOS and Android app versions. QA specialists will test the code and each feature to eliminate bugs. After your app is ready for public release, it will finally be launched on the market. There is also post-production maintenance and support to ensure your app delivers a proper experience to customers and develops timely updates with new features,

It would be great for your company’s employees to consult the team regarding specific insurance processes and procedures. Thus, the future application is like a 'virtual insurance office' that should work similarly to on-site customer service.

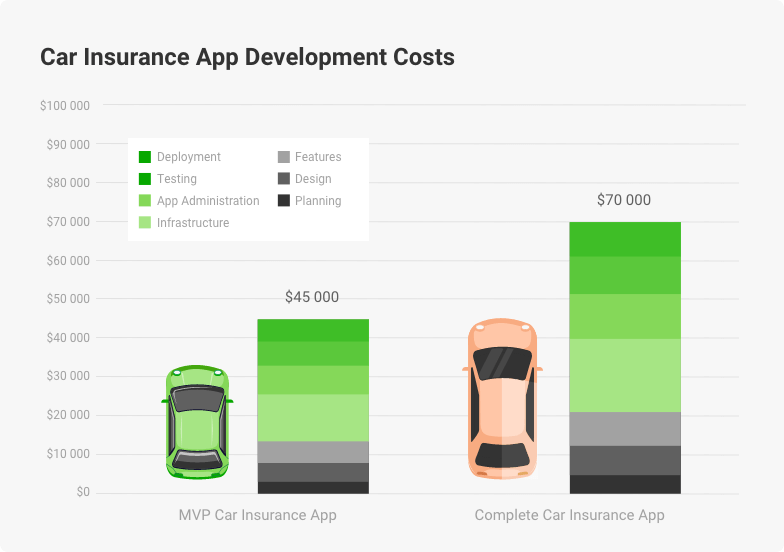

8. The Cost to Develop a Car Insurance App

It is highly recommended to start the project with an MVP (minimum viable product) development that will help to launch the product and get the first users faster. MVP version contains basic functionalities to deliver major company’s services and ensure the product’s viability before investing bigger funds into a complete product version.

If you decide to go for both iOS and Android native versions for your auto insurance app, the approximate MVP cost will start at $45,000, assuming that the average rates for developers and other team specialists are $40-$50 per hour (for Eastern European teams). The budget may grow when adding extra features, especially if you want to deal with advanced technologies like AI and ML-based algorithms for automating customer care. The complete insurance app development cost starts at $70,000.

The Cost of Creating an Auto Insurance App Will Depend on the Version of Application

To get a precise budget evaluation, address your project idea to our experts.

Conclusion

If you don’t want to stay behind the leading companies on the market, building a car insurance application is a reasonable step to please customers who value convenience. Let them have instant 24/7 access to your services in their pocket.

Based on your company’s needs, the KeyUA team can build a custom solution to deliver on the market. We have ample experience digitizing insurance services, automating data processing, and customer care using the most up-to-date technologies. Let us help boost your business efficiency, safety, and profitability with an innovative insurance application.

Bring your car insurance business to the next level with a robust application for automated customer service.

Contact KeyUA

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Comments

Leave a comment