The insurance industry is now facing rapid digital transformation, while consumer expectations and habits are also changing dramatically. Customers no longer prefer using web forms. Now, they actively use mobile apps and messaging instead of phone calls and in-person contact with the insurer.

Customer care should be more excellent than ever to keep the customer satisfied, loyal, and retained. And that is where AI insurance chatbots come into play. See what benefits an AI-based chatbot can bring to policyholders and insurers, what challenges are hidden inside, and how to manage them during the implementation.

The Impact of AI Chatbots for Insurance

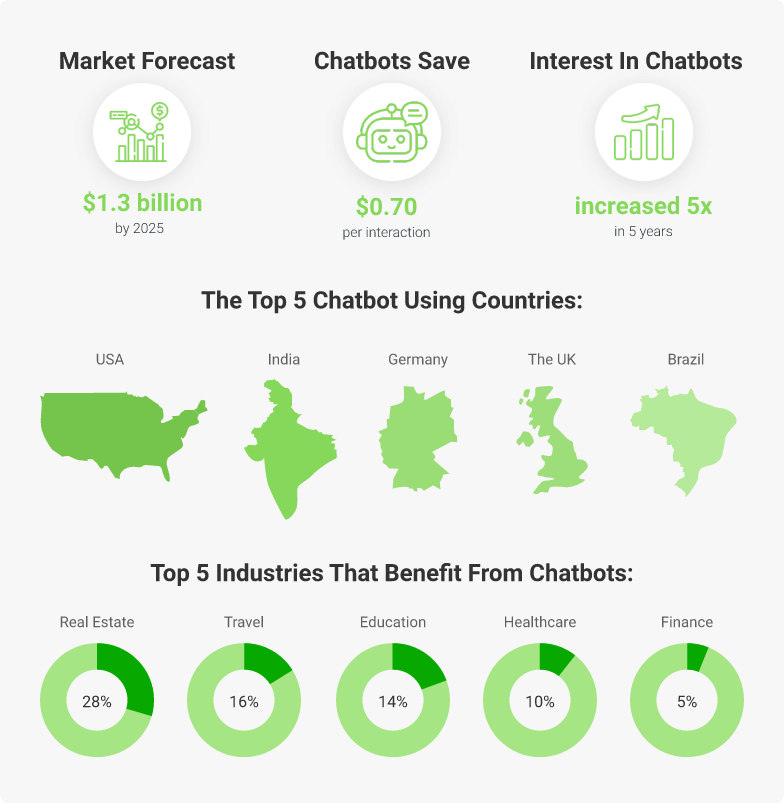

Chatbots are one of the most popular applications of artificial intelligence in insurance. In the struggle to optimize customer service, insurance agencies are actively adopting virtual assistants and chatbots. As a result, the global chatbot market size is growing at a CAGR of 24%. By 2025 it is expected to reach $1.3 billion, according to Cognizant.

Global AI Chatbot Market Statistics 2021 (Source: aimultiple.com)

A few factors drive the rapid growth of AI insurance chatbot popularity, namely:

- Digital transformation of the industry aimed at automation

- The rise of messaging apps: messaging is the preferable type of communication

- The explosion of the app ecosystem: consumers prefer applications to apply for financial services

- The evolution of AI and cognitive technologies: the innovations become more accessible and easy to adopt

- Fascination with conversational UIs: modern chatbots can replicate human-like assistance.

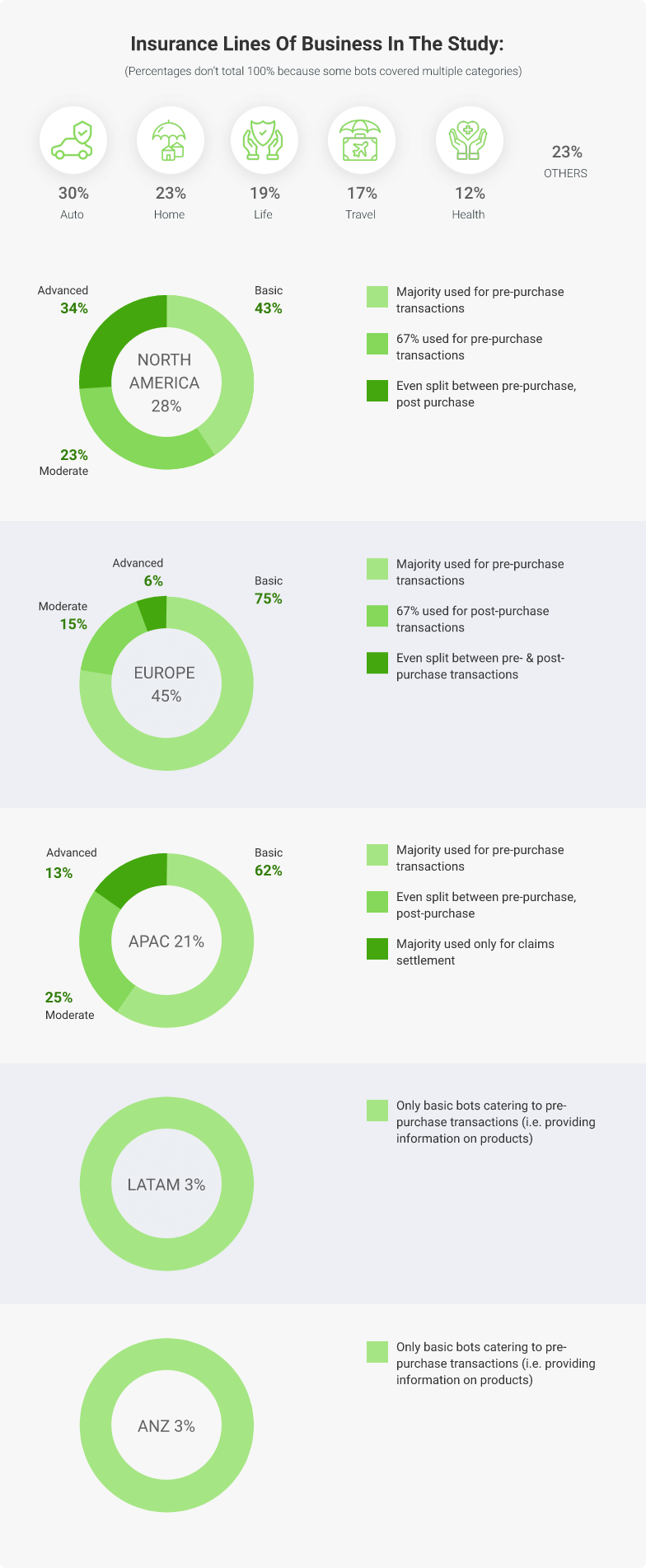

The Cognizant report also shows that Europe is the leader in adopting chatbot technology in the insurance sector, followed by North America:

A Global Comparison of AI Chatbot Adoption (Source: cognizant.com)

Despite leading the global market in the number of chatbots, Europe lags in terms of technology advancement. American insurers implement more advanced bots, while European ones provide only basic features for their clients. Overall, most chatbots across the world remain at a basic level, and now insurance companies are investing in enhancing their bots’ capabilities to maximize value for their business and customers.

Planning to develop a custom insurance application with the latest technologies on board? Check our Insurance App Development Guide.

TOP Insurance Chatbot Use Cases

In most case studies, a chatbot is considered a customer service tool. It plays the role of a virtual assistant performing specific actions to provide a user with required information instead of a human manager. In practice, chatbots collect valuable information about customer behavior and demands. As a result, it helps sales teams understand their target audience and clients better, provides relevant, personalized offers, and increases the agency’s profits.

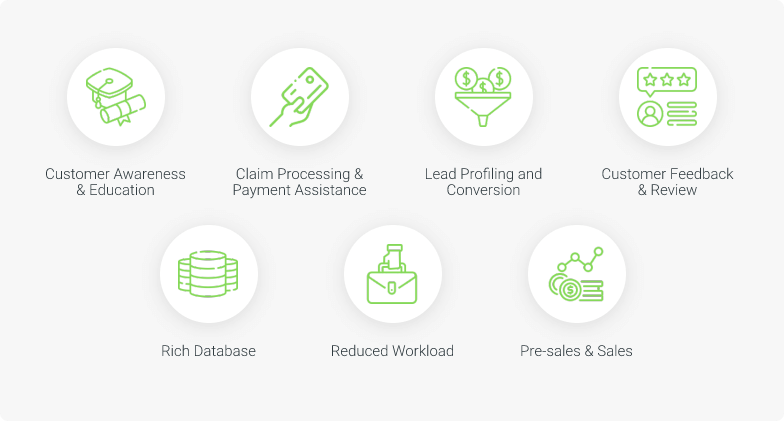

7 Use Cases of Insurance Chatbots

Consulting users is only one of the chatbot capabilities for insurance. Modern AI bots can perform numerous operations, saving your human resources and operational costs. Here are the most popular use cases of chatbots for insurance.

- Customer awareness and training: bots can educate your clients and potential customers on how your services work and provide instructions for performing actions like filing a claim, purchasing a policy, etc.

- Claim processing: a popular feature for an auto insurance chatbot is guiding a client through the filing claim process, ensuring all necessary details and photos are properly uploaded. Bots can also assist in checking the progress of existing claims.

- Lead conversion: based on user queries, input, and behavior, a bot can output relevant quotes and other information to help make a purchase.

- Customer feedback: 73% of customers consider live chat as a preferable communication channel with companies.

- Lead generation: 42% of customers prefer leaving their contact information via a live chat, significantly impacting lead generation.

- Reducing workloads: Automating communication with customers and potential buyers is the most significant economic advantage of AI chatbots in insurance. While bots are doing routine tasks, the sales and marketing team can focus on boosting their sales results.

- Pre-sales and sales: according to Marketing Dive, 47% of online shoppers are open to purchasing through chatbot experiences. By giving the right message to each potential customer, a chatbot can successfully guide them down the purchase funnel.

An AI chatbot is the first step of interaction between a consumer and your brand. It takes much less time for a person to get all required policy information via chat than to listen to the same during a phone call. A dynamic answer & question mechanic helps keep a customer engaged, solving most trivial queries quickly. Having an intelligent AI-based chatbot is a must for the modern customer experience in the insurance sector.

Interested in the best usability practices to improve the customer experience? Review our 11 TOP insurance website design examples for more insights.

Benefits of Conversational AI Chatbots for Insurance

The advantages of the chatbot technology for customers and insurers are interdependent. The higher customer satisfaction is, the more commercially successful the business is. Here are the most significant of these benefits:

- 24/7 availability: customers can submit their queries for assistance at any moment, including at night, weekends, and holidays. The cost of providing the same availability and quality of service within human consultants is enormously higher than implementing a chatbot.

- Immediate response: people expect quick answers to their questions if they plan to spend money on your services.

- Convenience: compared to emails, a live virtual assistant is significantly more efficient and quick. Users are not always comfortable making a phone call while working at the office or during the nighttime. Chatbots are perfectly suitable for all those situations.

- Time and money efficiency: chatbots save employees time and employers money on performing routine customer support operations. The team can focus on other goals.

- Personalized support on all platforms: you can launch an insurance website with a chatbot widget and integrate it into a mobile application, social network accounts, and other channels.

- Data collection: chatbots can collect all data received from customers to classify the target audience’s queries, detect most converting conversation scenarios, etc.

- Improving customer engagement: interactive virtual assistants help brands constantly engage with the customers providing instant responses without waiting. People increasingly feel comfortable addressing their queries to a machine intelligence than to a human.

There are three key metrics to calculate the ROI of the chatbot for the insurance business to see if it justifies the company’s expectations:

- Query resolution time: it helps measure the time saved per customer query/support ticket. It is often compared to the average time a live agent needs to resolve a query.

- Cost savings: measure how much work a chatbot can handle on one live agent (or the entire team). Again, you can compare time and cost spent on customer care before adopting a bot with time and cost to manage the same operations after (for a specific period).

Internal and external satisfaction rates: measure the changes in the overall satisfaction of customers and live agents after implementing a bot.

Create a conversational virtual assistant for your clients with the KeyUA team. Use the latest AI technologies to optimize your insurance business.

Get In TouchKey Insurance Chatbot Features

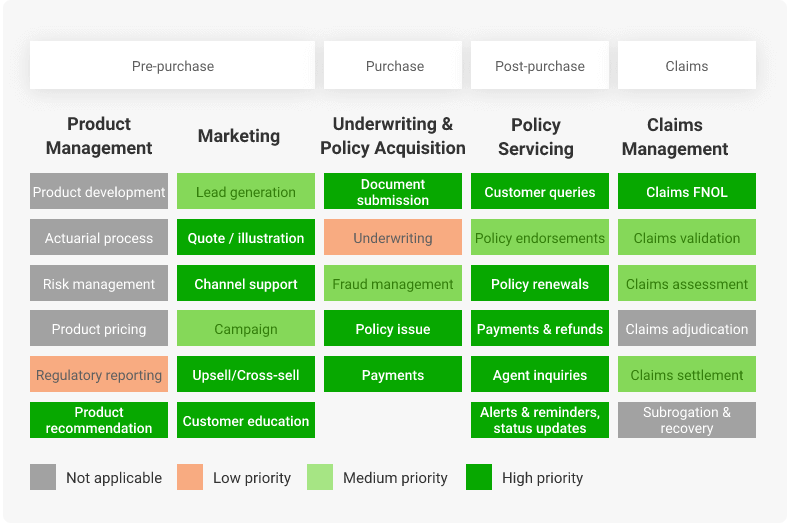

There are five key areas where chatbots can bring maximum value for business with minimum effort for implementation:

- Handling customer queries

- Handling claims first notice of loss (FNOL)

- Providing relevant product recommendations

- Quote illustration

- Customer education

Currently, chatbots are primarily used in pre-sale activities for property & casualty insurance due to the lower complexity of home and auto lines products. On the other hand, a chatbot for health insurance requires more complex algorithms to personalize CX. Yet, they are successfully used to analyze a customer's financial needs and estimate rates for term life plans. Here are the most prominent functionalities modern chatbots can cover:

Top-Priority Chatbot Functions

The final goal for any chatbot is making interactions as human. Thus, users except chatbots are the same as live agents: maximum personalization, relevance, and value of the provided assistance.

Challenges of Implementing AI Chatbot for Insurance

Each technology has its pros and cons. Despite all the benefits human-like virtual assistance can bring, there are specific issues in integrating conversational AI chatbots for insurance companies. Here are the main challenges to overcome for a successful implementation.

Impersonal interface

If your chatbot looks too robotic and impersonal, it will frustrate users. Equipping it with ML and NLP capabilities to design a human-centric interface may help personalize the user experience, make interactions and their results more accurate.

Contextualizing Conversations

Early bots operated based on programmed algorithms and preset response templates without understanding the specific context. Modern technologies allow increasing the understanding of natural language nuances and individual user patterns to respond more accurately.

No Multi-Language Support

Multi-language support is available only for basic chatbots. For now, NLP hasn’t matured enough to let a single bot act like a human in multiple languages. As a result, it can be a problem when developing a chatbot for multilingual countries with numerous dialects like India.

Combining Chatbots and Humans

Chatbots are often considered as a replacement for humans. However, within the insurance business specifics and current technological limitations, it would be better to combine bots with humans. In critical moments customers still rely more on personal assistance by agents. The co-bot approach is better in terms of fulfilling proper CX.

‘Push’ Marketing

Planning to use a chatbot as another channel to push spam to customers is entirely unwise. Customers are tired of ‘push’ marketing, and such an investment would not bring desired results yet can significantly affect customer satisfaction. Instead, bots should be used as a new channel for developing conversational, interactive connections with the target audience and existing customers.

Scalability

Smart, intellect-powered chatbots are a resource-consuming technology. It implies processing enormous amounts of data for proper output. Therefore, developers need to plan for potential growth in traffic and data processing loads when choosing technologies and environments for a future chatbot.

Data Protection

One of the most significant issues of AI chatbot and insurance combo is data privacy. Insurers need to keep in mind all data privacy and security regulations for the region of operation. International insurers must comply with all local laws regulating online data sharing. A comprehensive governance framework and advanced ML algorithms can help chatbots to stay in regulatory compliance.

Insurance Chatbot Examples

Before planning your chatbot development, see how the insurance companies already use this innovative tool to engage their consumers.

First-Ever Insurance Chatbot: Aflac’s DuchChat

The first major insurer to launch a customer service chatbot was Aflac, one of the leading supplemental insurance providers. They released their AI-based DuckChat on Facebook Messenger in 2017. It helped answer consumers’ questions during the benefits enrollment season.

Aflac DuckChat Commercial

It was a basic chatbot that texted users upon their request, recognizing queries programmed in its algorithm. Since then, the company has significantly upgraded its bot, and now it is a voice-enabled virtual assistant with a 3D avatar.

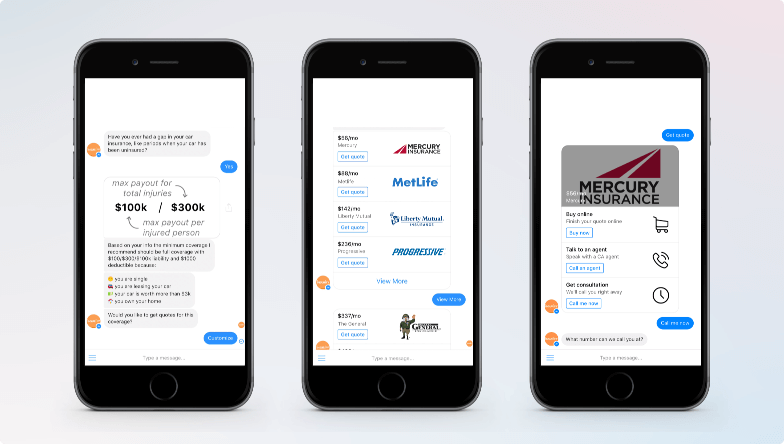

Auto Insurance Chatbot: Insurify

Insurify offers Facebook Messenger-based chatbots to suggest the best car insurance offers from 655 providers based on the user’s input information. According to the company, it takes only 2 minutes to get the right quotes using their virtual agent. And it provides the same qualification of service as if you call a live agent.

Insurify Auto Insurance Chatbot

Users can also subscribe for alerts to monitor the most competitive rates. In addition, Insurify has become the first insurance aggregator to integrate with Facebook Messenger to provide customers with a chatbot experience.

The KeyUA experts help insurance companies improve their customer service within custom software products. Find out how to build a car insurance application with our team.

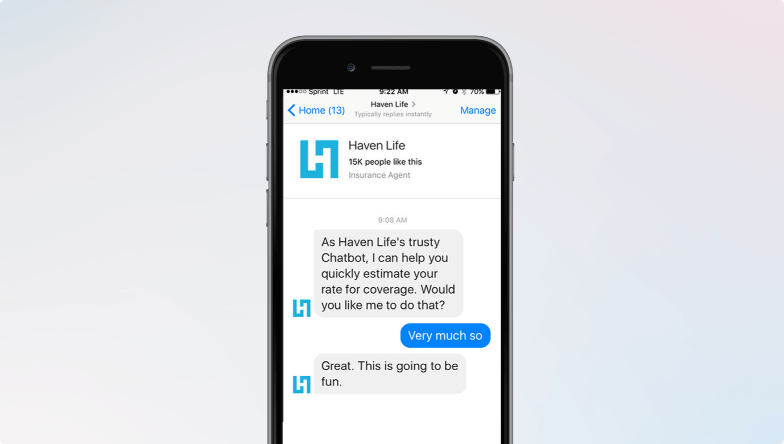

Life Insurance Chatbot: Haven Life

Haven Life Insurance, a startup funded by MassMutual, uses chatbot technology to calculate life insurance needs and offer customers quotes for monthly rates based upon the chosen plan.

Haven Life Insurance Chatbot

The mission behind this solution is to educate Americans on the actual cost of financial life protection in an innovative conversational manner.

Final Thoughts

The need to automate customer experience in insurance is no longer a question. It has become an industry standard. AI-based insurance chatbots are one of the most demanded technological upgrades among insurers. They can improve customer loyalty and brand engagement, cut expenses, and generate additional income for the company.

To make this innovation work the right way for your business, you should deliver a high-end conversational experience, personalized and highly relevant to customers' requests. The KeyUA team can help develop a custom chatbot solution that will interact naturally with customers in the manner they desire to get the maximum benefit from using AI technologies the right way!

Bring an automated, natural-like experience to your customers with an AI-powered chatbot. Choose the best approach for your specific needs with the KeyUA experts.

Contact Us

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Unit 1505 124 City Road, London, United Kingdom, EC1V 2NX

Comments

Leave a comment